The spring ploughing period is approaching, and China's pesticide market is embracing a boom in the demand for amide herbicides, according to CCM.

China's 2016 spring

ploughing signals the busy season for the pesticide market, among which the

herbicide market is the first beneficiary. In particular, amide herbicides have

been very popular.

At present, China's amide

herbicides are in a good market where the supply of upstream raw materials is

tight but the demand from the downstream market is high. Firstly, the prices of

upstream raw materials like chloroacetyl chloride and MEA rise rapidly. The

tight supply is largely due to environmental pressures. Chloroacetyl chloride

price quotations have risen up to USD1,835/t (RMB12,000/t) at some factories,

which undoubtedly supports the amide herbicide price to go up.

Secondly, as the demand

from herbicide end users expands and formulation processors begin to purchase

technical according to their production plans, the entire herbicide market is

entering into the busy season. In general, March to April every year is China's

spring ploughing period. Amide herbicides including acetochlor, metolachlor and

pretilachlor are selective pre-emergence herbicides. They are important

herbicide varieties during the spring ploughing period and have large market

demand during this period.

Acetochlor TC, metolachlor

TC and pretilachlor TC are in great demand and are in tight supply because of

the current strong market. This is mainly because formulation suppliers need

time to stock up goods for the start of the market demand. However, most TC

manufacturers have inventories to consume since these products did not sell

well in 2015. As of early-March 2016, most amide herbicide TC manufacturers are

still suspending their production and their supply of goods is based on the

previous inventories. But influenced by the rising price of upstream raw

material, the prices of above three herbicide TC are increasing.

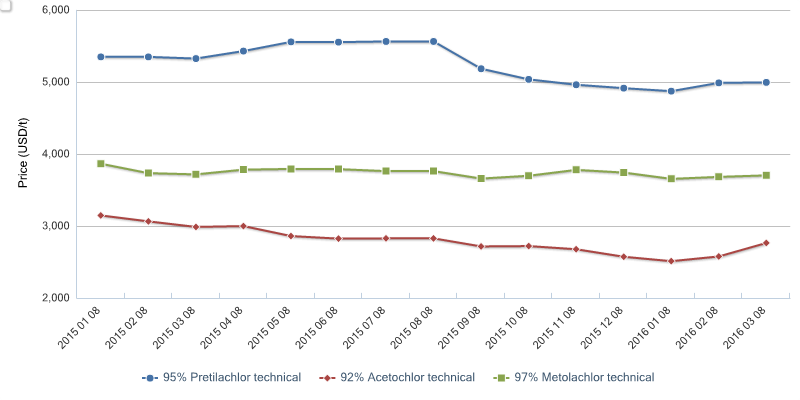

Domestic formulation

prices are also increasing because of the rising TC price. In 2015, the lowest

ex-works price of acetochlor TC was USD2,575/t (RMB16,500/t). The price has

rebounded to about USD2,767/t (RMB18,000/t) now, a growth rate of 9.1%. At

present, the quotation of metolachlor TC reaches USD3,705/t (RMB24,100/t), up

by 4.8% when compared to the bottom price of USD3,518/t (RMB23,000/t) during

2015. The price of pretilachlor TC has also rebounded, but its growth rate is

lower than the other two formulations. In detail, the quotation of pretilachlor

TC is about USD4,997/t (RMB32,500/t), about USD153/t (RMB1,000/t) above the

2015 low, and a rise of 3.1%.

Industry insiders forecast

that the prices of related formulations will keep rising in the short term due

to the rising processing costs. But if the market fluctuates, prices will also

be affected.

Acetochlor, metolachlor

and pretilachlor are major pre-emergence herbicides in China, with relatively

high consumption. Nevertheless, due to the serious capacity expansion and

overcapacity, the prices of these herbicides have not recorded large rises in

recent years. History indicates that the prices of these herbicides will not

rise significantly in the future. Currently, Nantong Jiangshan Agrochemical

& Chemical Co., Ltd., Henan Yintai Chemical Co., Ltd. and Shandong Binnong

Technology Co., Ltd. are main amide herbicide TC producers in China.

Ex-works prices of pretilachlor TC, acetochlor TC and metolachlor

TC in China, Jan. 2015-March 2016

Source: CCM

About

CCM:

CCM is the leading market intelligence

provider for China’s agriculture, chemicals, food & ingredients and life

science markets. Founded in 2001, CCM offers a range of data and content

solutions, from price and trade data to industry newsletters and customized

market research reports. Our clients include Monsanto, DuPont, Shell, Bayer,

and Syngenta.

Tag: amide herbicides